Tim has recently approved its strategy plan for the three-year period 2021-2023. The project is named Beyond Connectivity, and not by chance, as it traces the path for the development of the group’s video-television offer, placing it at the core of an overall strategy that should lead the market leader to develop into an integrated media operator in all respects. The Beyond Connectivity venture comes after a long period marked by a “difficult relationship” with the audiovisual market, often spotted by uncertainties and sudden changes of gear and strategy choices.

When Italian group TIM was still SIP, at the time of its domestic monopoly, it was among the first telecommunications groups to take the path of pay-TV and Video-on-Demand (VoD) – and with determination, as proven by its memorable Stream network developed in the mid-Nineties in the midst of the first “epic” Information Highway and the advent of digital networks. After selling Stream, which in 2003 merged into the newborn Sky Italia, Telecom Italia’s adventure in pay-TV was brusquely interrupted to resume timidly but unsuccessfully a few years later with IPTV and then in 2010 with CuboVision, an ambitious media player that gave birth to TimVision, which today offers live streaming channels and VoD services and has also begun to produce original series and docuseries (such as Skam, Dark Polo Gang, Sinatra, L’amica geniale).

Today, TimVision’s paid offer is structurally integrated with Tim’s broadband offer. Clearly, the group follows the path of all major telecommunications operators who are also the new pay-TV players. In almost all countries, as a matter of fact, “traditional” linear pay-TV is now fully integrated with broadband offers and the two markets operate by the same token. In the US, the most important mergers (AT&T with DirectTV and eventually with Warner Media; as well as the acquisition of Dreamworks’ NBC Universal by Comcast, and then of Sky) have outlined the new market scenario, transforming telecommunications operators into the new “cable TV” operators – pay-TV and Over-the-Top offers being today increasingly integrated.

Now, two basic factors have pushed Tim to enhance its video-television offer, consequently strengthening its presence on the linear/non-linear pay-TV market. Firstly, Tim has to face the competition on the broadband market, including the entry of Sky/Comcast, which already has a significant user-base (pay-TV subscribers) on its side. In the United Kingdom, Sky has long been the second largest telecommunications operator with a market share of 24% while BT (British Telecom, the historical incumbent) is “only” at 25%. But BT managed to keep its 25% only thanks to billionaire investments in sports that have made it the second pay-TV operator.

Tim can no longer delay this venture: it must accelerate the formation of a strong video-television offering, as already anticipated in 2020 with various agreements (Disney+, Netflix, DAZN, NowTV, Discovery+). However, now it must make a leap towards exclusive content, the only element of real strength in the competition among bundling offers. It is no coincidence, in fact, that the competition (and contention) is for the time being ignited on prominent sports rights, a crucial terrain for both “historic” and new-generation pay-TV operators.

The second element that urges Tim to take important and more crucial steps (and therefore investments) concerns the churn rate (cancellation rate) of fixed and mobile broadband offers. Triple or quadruple plays (the offer of integrated connection packages, voice, and video services) reduce the cancellation rate and the migration of customers to other operators. Furthermore, the acquisition costs for new customers (CAC, Customer Acquisition Cost) have significantly dropped, as well as the so-called Retention Costs, which are the costs sustained to reduce the cancellation rate. On the other hand, the results of the TimVision’s offer boost came around immediately: at the end of 2020, the latest indicators indicated a sharp reduction in churn rate.

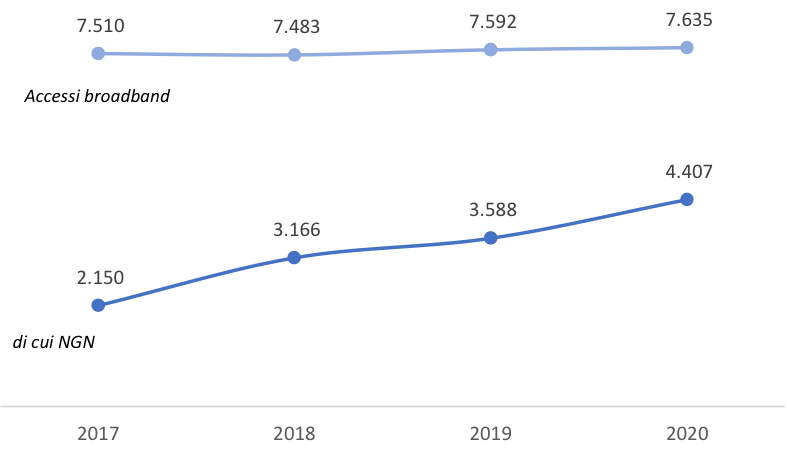

With a fast-growing SVoD market and a customer base of landline broadband users that has reached 7.6 million (of which 4.4 on ultra-broadband or NGN), TIM is a candidate to become the second pay-TV operator or perhaps the first if it takes important steps on the content market. Sports may not be enough, and in that case Tim would need to go back to its “Tim Originals“.

TIM broadband accesses on the retail market (000)