As known, the measures imposed by the domestic lockdown to contain the COVID-19 pandemic has spurred practically all media consumption. In particular, the time spent between March and April on TV and the Internet on all platforms has grown significantly. In the United States, the consumption of gigabytes via the Internet only in the first quarter of the current year, and mainly thanks to the month of March, has registered a 47% leap compared to the last quarter of 2019 (source: OpenVault – OVBI 1Q 2020). In the UK, the first day of actual lockdown (March 23) witnessed a significant increase in Internet consumption. These figures eventually experienced a further leap the day after the launch of the SVoD service Disney+ (Source: IspReview).

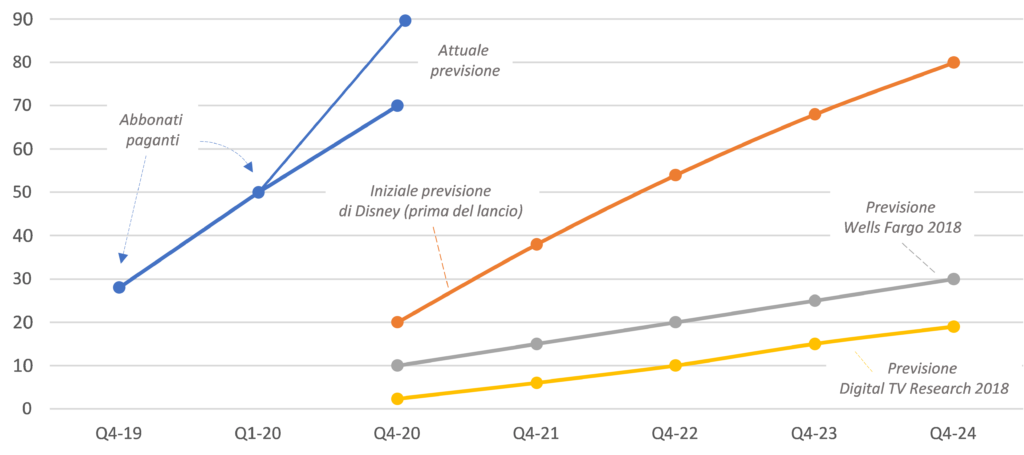

On the media front, the launch of Disney+ was undoubtedly the most important event of the first few months of 2020 – certainly expected, but unexpected in its results. Launched in the USA in mid-November 2019 and then on many other markets, including Italy in the midst of the pandemic, Disney+ has reached 50 million paying subscribers in just 5 months after launching on its domestic market (data referring to the global number of subscribers in early April).

At the end of the fiscal year (September 2020), the total number of Disney+ subscribers might approach the goal initially set (only a year ago) for the end of year 2023: a figure placed around 60-70 million subscribers. Netflix expects 192 million at the end of June 2020. That distance that seemed unbridgeable has now been significantly reduced.

The success of Disney+ is the result of the historical strength of the Major and its powerful library that controls a non-easy yet extremely high-valued target, in addition with the time’s circumstance: the lockdown of entire families that has awarded SVoD consumption – for kids, as well. Not only: the success of Disney+ also comes from its perfectly complementary nature with Netflix’ offer, also thanks to its advantageous price.

Disney+ seizes with “natural precision” that double subscription market space: a second subscription with access to an extremely vast offer with an overall cost of less than €15 per month. This second subscription, however, is a third one for many users, since the Amazon Prime Video subscription is perceived as free, being free of charge to the subscribers of Amazon Prime. At the end of 2019, there were 14.3 million households on the British market with access to a SVoD service (50% of the total penetration). Among these, 6.3 million are equipped with a double or triple SVoD subscription.

It is definitely probable that the launch of Disney+ and its unexpected success shall not represent a threat or a stall for Netflix, because thanks to its offer, target and current price, the new service completes the possible “menu” of streaming offers compatibly with families’ expectations and means (time, economic resources, interests).

Therefore, for several reasons, (price, target, value and content exclusivity), the three services that guide the SVoD market starting from 2020 (Netflix, Amazon Prime Video and Disney +) form a complete and “steady” pay package. There will certainly be competition for the production of original content (with great focus on local markets) but none of the three seem destined to suffer from the presence or growth of the other.

Looking ahead, even in a short term, the real problem arises for other players within or entering the market, since family budgets, and therefore prospects of success, are considerably reduced. This applies not only to other global players, starting with Apple with Apple TV, HBO (the launch of HBO Max is scheduled for May 27 at a price of $12 per month), NBC Universal (which launches Peacock in July) but also for other operators already on the market (such as Now TV, present in the UK, Italy, Germany and Spain).

In addition to those currently occupied by the three market leaders that offer complementary content as mentioned above, what are the possible voids in paid video streaming? Indeed, there are three areas of possible coverage that can or will be occupied by the fourth (and fifth) market players:

- there are still openings for films and TV series produced and conveyed by major channels / brands / television studios (domestic and international);

- sport also offered as a day pass (a formula that was one of the levers of Sky’s NowTV service);

- big entertainment events.

The second two areas (2 and 3) involve live streaming, a strong safeguard for linear broadcasting, but all three together represent opportunities (perhaps the only opportunities) to gain SVoD presence for free and / or pay domestic players. At the same time, however, they are also the three steady “survival” areas for linear pay-TV.

Once the first

historical era is completed (erosion of the physical home video), the SVoD

market will necessarily evolve in the direction of a greater overlap with the current

premium broadcast offers. The strategic question concerns the three areas above,

meaning how much content and editorial events that are still owned by linear

broadcasting shall remain in the hands of “historical” television players

or shall slowly but surely slip into those of the current SVoD leaders.

Evolution forecast of Disney+ subscribers and current paying subscribers (in millions)

Source: eMedia on Disney data and other sources